This time of year, many people get holiday jobs to earn extra money. That means some people will get injured at work and run into other difficulties working holiday jobs. Here are six tips on how to deal with the workplace challenges arising from holiday jobs. These tips for safe and fair employment apply just as well to any second job, not just a holiday job.

- Just because you have a “holiday job” doesn’t necessarily make you a seasonal employee: In some states, including my home state of Nebraska, employees can have their benefits reduced if they are a “seasonal employee.” However, even if you have a holiday job, your job may not be seasonal. In Nebraska, “seasonal employment” is defined as a job that is dependent on weather or can only be done during certain times of the year. For example, if you hurt your back working at an electronics store at your holiday job, that employment is not seasonal because you can work at an electronics or really most any retail store at any time of the year.

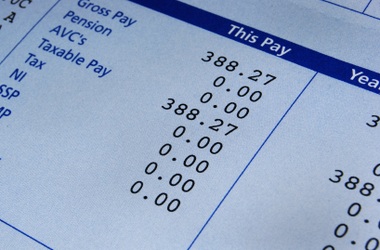

- You can’t be paid workers’ compensation for how your holiday or second job affects your regular job: If you are off work at your regular job because of an injury at your second job or holiday job, you are only paid income-replacement benefits for the income you lost at your holiday job or second job. For example in Nebraska, if you were hurt at your holiday/second job that pays $120 per week and you are unable to do your regular job that pays $600 per week, your only income benefit would be two-thirds of your second/holiday job, which would be $80. Employees should be extra cautious in second jobs or holiday jobs for just that reason. Employees should also consider applying for private disability plans if they plan on having a second job in order to account for the possibility of losing income due to an injury at their second job. In short, employees should do a thorough cost-benefit analysis before taking a holiday job or second job.

- Your permanent disability benefits could be better than your temporary benefits: In full-time employment, permanent and temporary disability benefits are generally fairly close. But with part-time employment, permanent disability benefits may be much higher than temporary benefits. In my state of Nebraska, temporary benefits are paid based on a typical work week. For example, if you are a part-timer working 12 hours a week at $10 per hour, your temporary disability pay would be $80 a week. However, in Nebraska and some other states, permanent disability is based on no less than a 40-hour week. So if you are a part-timer getting paid $10 per hour, your permanent disability rate would be $266.67 per month. This is good for employees, because serious injuries will usually have permanent effects that can permanently affect an employee’s ability to earn a living.

If you are an injured part-time worker and your insurance company is trying to force you to take a settlement based on your part-time wage rate, you should consult with an attorney in your state.

- Your employer/insurer may be low-balling your wage rate: Say you get paid $8 an hour as a barista but you have an agreement to share tips, or you work in retail but you get store credit, or you teach exercise classes at a health club but you have an agreement that you get a free membership. In any of those scenarios, you could possibly use those benefits to increase your loss-of-income benefits.

- You are still protected by most fair-employment laws: Part-timers are still covered by most fair-employment laws. The most glaring exception is likely the Family and Medical Leave Act (FMLA), which provides 12 weeks of unpaid leave and job protection for employees with a serious health condition, to care for a close family member with a serious health condition, or take care of a close family member who is affected by a military deployment. FMLA requires 1,250 hours worked in the last calendar year and 1 year of employment. That 1,250 hours a year translates to roughly 24 hours a week. Many people working second jobs don’t meet the eligibility standards for FMLA.

- Independent contractor, independent conschmacktor: Many holiday employees do fairly low-wage work that doesn’t require any specialized training or education. If this describes your holiday job or second job, then you are an employee, despite the fact that your company may have classified you as an independent contractor. Since you are an employee, you should be covered by workers’ compensation law. If you are misclassified as an independent contractor, you should look for other employment and consider reporting your unscrupulous employer to the United States Department of Labor or to your state’s department of labor.